The UK property market is currently experiencing an unusual period of hesitation as homeowners and prospective buyers await Chancellor Rachel Reeves’ Autumn Budget on November 26, 2025. Recent research reveals that uncertainty surrounding potential policy changes has created a temporary pause in market activity, with significant numbers of homeowners delaying their moving plans until the fiscal landscape becomes clearer.

Current market uncertainty

Recent findings indicate that approximately one in five UK homeowners have placed their plans to sell on hold pending the Budget announcement. Among those concerned about affordability, 46% cite Budget uncertainty as the primary reason for postponing their sale. The hesitation extends beyond sellers, with 38% of prospective buyers expressing concerns about their ability to meet stamp duty obligations on new properties.

The concerns are multifaceted. Research shows that 57% of homeowners worry about hidden moving costs including solicitor fees, surveys, and removal services, whilst 53% cite interest rates and mortgage affordability as key deterrents. Perhaps most tellingly, 26% express anxiety about job security in the current economic climate, demonstrating that property decisions are increasingly influenced by broader economic uncertainties.

This cautious approach has created a ‘wait and see’ mentality, with homeowners reluctant to commit to major financial decisions without clarity on potential policy changes. Regional variations are notable, with homeowners in London, the East of England, and Wales showing particularly heightened concern about potential tax modifications.

Property price trends and market activity

The Halifax house price index for September 2025 recorded a modest decline of 0.3% compared to the previous month, bringing the average UK property value to £293,399. This represents annual growth of 4.3%, suggesting the market remains fundamentally stable despite current hesitations. The slight monthly decrease reflects broader caution rather than any fundamental weakness in property values.

Interestingly, whilst buyer activity has moderated, the supply side has shown resilience. Estate agency data reveals that September 2025 delivered notable increases in new property listings, with some firms recording an average of 81 new properties listed daily throughout the month. This 19% increase compared to August suggests that sellers remain motivated to enter the market, creating favourable conditions for buyers once Budget clarity emerges.

Government reforms: A positive outlook

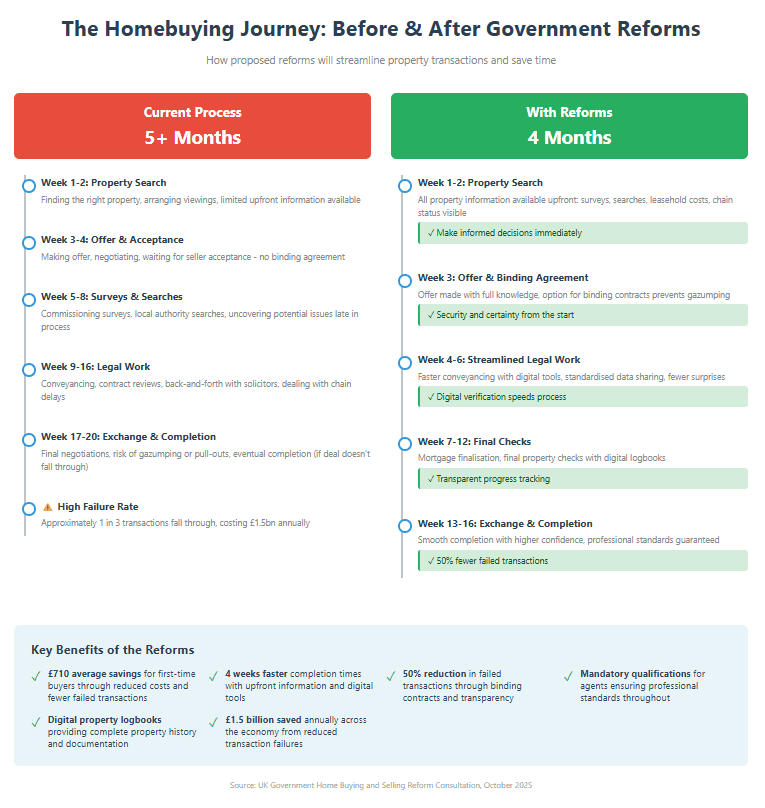

Amidst the uncertainty, the government has announced substantial reforms designed to modernise and streamline the homebuying process. These proposals, unveiled in early October 2025, represent the most comprehensive overhaul of the property transaction system in a generation and offer genuine grounds for optimism about the market’s future trajectory.

The reforms aim to reduce the average completion timeline by approximately four weeks, addressing one of the most persistent frustrations in the current system. First-time buyers stand to benefit particularly significantly, with projected savings averaging £710 per transaction. The proposals include mandatory upfront disclosure of vital property information, including condition reports, leasehold costs, flood risk data, and chain status, enabling buyers to make informed decisions earlier in the process.

A particularly significant proposal involves the introduction of binding contracts, designed to prevent parties from withdrawing from agreements after months of negotiations. This measure could halve the number of failed transactions, which currently cost the economy £1.5 billion annually. For homeowners and buyers alike, this represents not merely financial savings but substantial reductions in stress and uncertainty.

The reforms also propose mandatory qualifications and codes of practice for estate agents, letting agents, and managing agents, driving higher professional standards across the sector. Digital transformation features prominently, with proposals for digital property logbooks, standardised data sharing, and enhanced verification processes, bringing the property transaction process into alignment with consumer expectations in other sectors.

What the Budget might include

Speculation surrounding the November Budget centres on several key areas that could impact property transactions:

Stamp Duty: Following the end of temporary relief measures in April 2025, further modifications to stamp duty thresholds remain a possibility. Any changes would have immediate implications for transaction costs, particularly for first-time buyers and those purchasing properties in higher value brackets.

Capital Gains Tax: Potential adjustments to CGT rates or allowances could affect second home owners, buy-to-let landlords, and those considering downsizing or portfolio adjustments. Changes in this area would influence investment decisions across the property sector.

Inheritance Tax: Reforms to inheritance tax, particularly concerning property assets, have been the subject of considerable discussion. Any modifications could impact estate planning strategies for property owners.

Taxation on Rental Income: The possibility of National Insurance contributions being extended to rental income has generated discussion within the buy-to-let sector, though such a measure would represent a significant policy shift.

The path forward: Confidence after clarity

It is important to maintain perspective on the current market pause. The hesitation we observe represents rational caution in the face of uncertainty rather than any fundamental weakness in property demand or values. Historical precedent suggests that markets respond positively once policy clarity emerges, with pent-up demand often translating into increased activity.

The government’s comprehensive reform package demonstrates a clear commitment to improving the homebuying and selling experience. When combined with the resolution of Budget uncertainty, these reforms position the market favourably for a strong recovery in transaction volumes during late 2025 and into 2026.

Several factors support an optimistic outlook:

The fundamental demand for housing remains robust, supported by demographic factors and lifestyle changes. The increased supply of properties coming to market creates healthy choice for buyers. The government’s broader commitment to building 1.5 million homes signals long-term support for market growth. Professional standards improvements will enhance consumer confidence in the transaction process.

Preparing for your move

For those currently considering a property move, the present circumstances offer both challenges and opportunities. The temporary market pause may create favourable conditions for negotiation, particularly for buyers. Sellers who price realistically, taking account of current market conditions and potential buyer concerns, will be well-positioned to secure transactions.

Regardless of market conditions, the practical aspects of moving require careful planning and professional expertise. Whether the Budget brings significant changes or maintains the status quo, homeowners will continue to require reliable, experienced removal and storage services to facilitate smooth transitions between properties.

Conclusion

The period of uncertainty surrounding the Autumn Budget 2025 represents a temporary pause rather than a fundamental shift in the property market. Once Chancellor Reeves delivers her Budget statement on November 26, clarity will return, enabling homeowners and buyers to proceed with confidence.

The combination of government reforms designed to streamline and modernise the homebuying process, alongside the resolution of policy uncertainty, creates strong foundations for renewed market activity. The property market has demonstrated consistent resilience throughout various economic cycles, and there is every reason to expect a positive response once the current period of caution concludes.

For homeowners and prospective buyers alike, the message is clear: prepare thoroughly, seek professional advice where appropriate, and be ready to move decisively once Budget clarity emerges. The fundamental strength of the UK property market remains intact, and the reforms on the horizon promise to make the process of buying and selling property more efficient, transparent, and secure than ever before.

Prepare your move now

Use this quieter period to prepare your move, ensuring that when market confidence returns, you can act swiftly and decisively. Contact Alexanders Group today on 0333 800 2323 for expert advice and a free quote.

Updated Daily