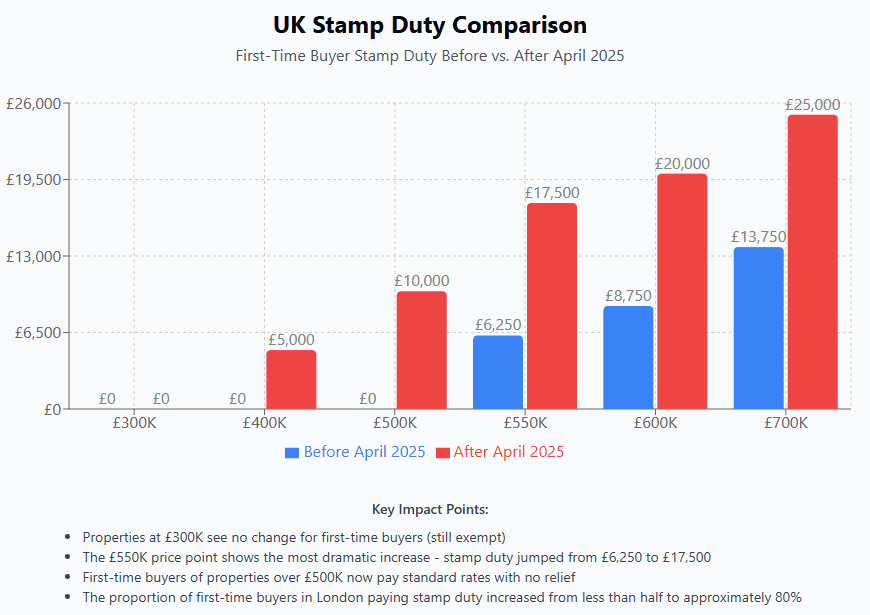

London’s property market is now experiencing a “stamp duty hangover” following the end of temporary tax relief measures, with demand for homes down 3% compared to this time last year, according to Zoopla. The shift has hit first-time buyers particularly hard, with the majority now facing significantly higher upfront costs. From April 2025, around eight in 10 first-time buyers in the capital are expected to pay stamp duty – a stark contrast to the previous threshold, which shielded more than half. In some cases, the increase has been dramatic: a buyer purchasing a £550,000 property has seen their stamp duty jump overnight from £6,250 to £17,500. Use our Stamp Duty Calculator to find out how you are affected.

Recent data from the first week of April shows transaction volumes have decreased by approximately 15% compared to the last week of March, with estate agents reporting a notable cooling in buyer enthusiasm, particularly in the £300,000-£500,000 price bracket most affected by the changes.

While the London housing market cools under the weight of these changes, other parts of the UK have seen steadier demand, reflecting a less severe impact from the policy shift. As the effects ripple through the capital, London is entering a subdued spring, marked more by hesitation than heat. In contrast the North East and North West are showing more resilience to the stamp duty changes than London and the South East. Property listings in these northern regions have increased by 5% since April 1st, while viewing requests have maintained steady levels, suggesting regional markets may recover more quickly than the capital.

March madness in the approach to the stamp duty deadline

In March 2025, the UK housing market witnessed a significant surge in activity as home buyers rushed to complete transactions before the stamp duty holiday concluded on March 31. Over 100,000 buyers in England and Northern Ireland aimed to finalise their purchases to avoid the impending tax hike. However, due to a sluggish conveyancing system, approximately 74,000 buyers were projected to miss the deadline, collectively facing an additional £142 million in stamp duty costs.

The run-up to the deadline triggered a frantic dash among buyers eager to beat the cut-off and avoid higher costs. This surge placed immense pressure on conveyancers, estate agents, and removals firms alike, creating a bottleneck of completions and a wave of frustration among those who missed out by just days.

Throughout March, Alexanders Removals & Storage experienced unprecedented demand as our clients sought to finalise their relocation before the deadline. Despite operating at maximum capacity and being fully booked for the entire month, we needed to provide a variety of bespoke solutions, including storage options for clients transitioning between properties. Inevitably, some clients had to reschedule in to April. We now have availability for those who were unable to secure a March appointment, though dates are booking up quickly. To arrange your distinguished relocation experience, we invite you to contact our dedicated client services team at 0333 800 2323.

April 2025: Current housing market conditions

The conclusion of the stamp duty holiday has led to a re-calibration in the housing market. The Spring Statement by Chancellor Rachel Reeves confirmed the end of the stamp duty relief, as the government focuses instead on spending cuts and welfare reductions to stimulate economic growth. The Office for Budget Responsibility’s annual growth projections for 2025 remain at the downgraded figure of 1%, with early April economic indicators suggesting this estimate continues to be accurate.

Despite these changes, the market is expected to see a steady pace of sales agreements throughout 2025 as more sellers, many of whom are also buyers, enter the market. House price inflation is anticipated to moderate further as supply grows and the additional costs of stamp duty in England influence house prices. While a slowdown in house price inflation isn’t a major concern, the market requires some price growth to encourage sellers to list their properties and buyers to make realistic offers. With ample demand and increased choice, households looking to sell in 2025 must carefully set their asking prices to attract sufficient interest. Consulting local estate agents for tailored pricing strategies is advisable.

Impact on property prices after the stamp duty holiday

Historically, increases in stamp duty have led to a temporary surge in transactions before the deadline, followed by a lull in the immediate aftermath. The recent tax change is expected to test the market, potentially leading to a slowdown or stabilisation in demand and, consequently, prices. This cooling-off period may bring much-needed stability, particularly for first-time buyers who have struggled with soaring prices and intense competition. Sellers in 2025 should be cautious when setting asking prices to ensure they attract sufficient demand to secure a sale.

Early indications from the first week of April show asking prices in London have decreased by an average of 1.2% as sellers adjust their expectations to accommodate buyers’ increased stamp duty costs.

Revised stamp duty rates post-April 2025

As of April 1, 2025, stamp duty rates have reverted to pre-holiday thresholds: Standard buyers:

- 0% on properties up to £125,000

- 2% on the portion between £125,001 and £250,000

- 5% on the portion between £250,001 and £925,000

- 10% on the portion between £925,001 and £1.5 million

- 12% on any portion above £1.5 million First-time buyers:

- 0% on properties up to £300,000

- 5% on the portion between £300,001 and £500,000 For properties over £500,000, standard rates apply without first-time buyer relief. For example, a first-time buyer purchasing a £350,000 property after April 1, 2025, would pay 0% on the first £300,000 and 5% on the remaining £50,000, resulting in a £2,500 stamp duty bill.

These adjustments underscore the importance for prospective buyers to be aware of the current tax landscape and plan their finances accordingly. Use our Stamp Duty Calculator to see how much you will have to pay now. Some mortgage lenders have responded to the stamp duty changes by introducing new products specifically designed to help first-time buyers, including options to add stamp duty costs to the mortgage amount, though these come with their own long-term cost implications.

Looking ahead: Summer 2025 property outlook

Market analysts are predicting a gradual stabilisation by June 2025, as both buyers and sellers adjust to the new stamp duty regime. The temporary lull in activity is expected to give way to a more balanced summer market, particularly if inflation continues to ease and mortgage rates remain stable. For those considering a move later in 2025, the current adjustment period may present strategic opportunities, especially if property prices soften in response to the revised stamp duty thresholds.

Why choose Alexanders for home removals

As London’s leading removal company Alexanders brings a wealth of expertise to your move, to ensure it is a smooth, efficient and stress-free experience. Whether you need house removal services or flat removal services we offer a trusted solution tailored to your needs.

Our expert team is on hand to bring calm and simplicity to even the most complex moves. Call Alexanders today on 0333 800 2323.

Updated Daily